State Government

New

Yardsticks

The state redefines "economic distress"

to help counties compete for new industries

By Steve Tuttle

Question:

If the economy was so good in North Carolina in

1999 then why has the number of counties

considered by the state to be severely

economically distressed nearly doubled?

Answer: Legislative politics surrounding the

state's premier economic development incentives

law, the Bill Lee Act.

The four-year-old law offers the most generous

state tax credits and other incentives to new and

expanding businesses in the poorest counties and

makes the least help available in the richest

ones. A new job created in a poor county earns a

business a $12,500 tax credit, for example; it's

worth just $500 in a well-to-do county. Other

state tax credits and incentives are similarly

scaled.

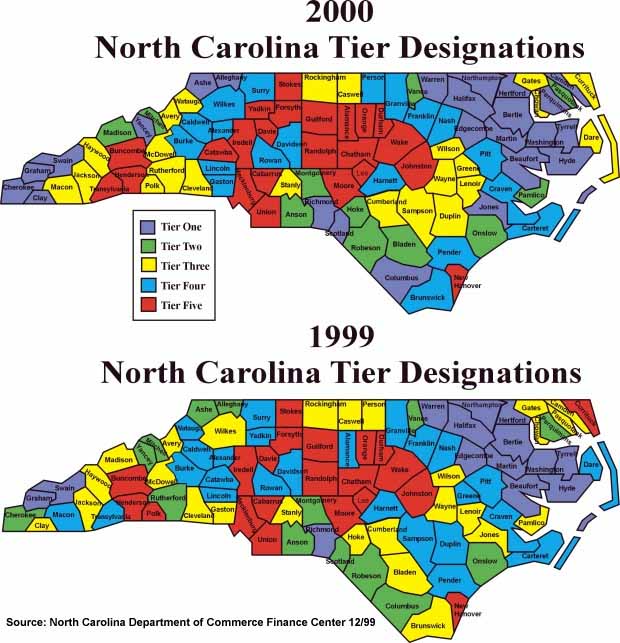

Each January the law requires the Commerce

Department to reassess economic conditions in all

100 counties and to assign each to one of five

tiers, with Tier 1 counties judged the most

economically distressed and Tier 5 counties the

least distressed.

Thirteen counties fell into the Tier 1

classification in 1999 (Bertie, Edgecombe,

Graham, Halifax, Hertford, Hyde, Martin,

Northampton, Richmond, Swain, Tyrell, Warren and

Washington) but the number jumped to 24 when

Commerce announced its rankings for 2000. New to

Tier 1 are Alleghany, Ashe, Beaufort, Camden,

Cherokee, Clay, Columbus, Jones, Perquimans,

Scotland and Yancey counties, not so much because

local economic conditions deteriorated last year

but because the General Assembly adopted new

yardsticks aimed at making it seem that way.

In fact, in a round-about way of bringing home

the bacon, three amendments to the Bill Lee Act

enacted last summer pushed 24 counties down in

the ranking system, making them eligible for more

generous business incentives than were available

to them last year:

Counties with fewer than 10,000 residents and a

poverty rate higher than 16 percent automatically

fall into Tier 1. That change affected Alleghany,

which was in Tier 2, and Camden, Clay and Jones,

which were in Tier 3, a relatively middle-class

status.

Counties with fewer than 10,000 residents and a

poverty rate higher than 16 percent automatically

fall into Tier 1. That change affected Alleghany,

which was in Tier 2, and Camden, Clay and Jones,

which were in Tier 3, a relatively middle-class

status.

Counties with fewer than 50,000 residents and a

poverty rate above 18 percent automatically drop

one tier. Falling to Tier 1 status as a result of

that change will be Ashe, Beaufort, Cherokee,

Columbus, Perquimans, Scotland and Yancey

counties. Retreating from Tier 3 to Tier 2 are

Bladen, Hoke, Madison, Pamlico and Pasquotank.

Duplin, Greene, Sampson and Watauga counties drop

from Tier 4 to Tier 3.

Counties with fewer than 50,000 residents and a

poverty rate above 18 percent automatically drop

one tier. Falling to Tier 1 status as a result of

that change will be Ashe, Beaufort, Cherokee,

Columbus, Perquimans, Scotland and Yancey

counties. Retreating from Tier 3 to Tier 2 are

Bladen, Hoke, Madison, Pamlico and Pasquotank.

Duplin, Greene, Sampson and Watauga counties drop

from Tier 4 to Tier 3.

Counties with fewer than 25,000 residents cannot

be rated higher than Tier 3. Previously included

in Tier 5, the state's most affluent counties,

Currituck and Polk counties drop to Tier 3 status

as a result of that change, while Dare and Macon

move down from Tier 4.

Counties with fewer than 25,000 residents cannot

be rated higher than Tier 3. Previously included

in Tier 5, the state's most affluent counties,

Currituck and Polk counties drop to Tier 3 status

as a result of that change, while Dare and Macon

move down from Tier 4.

Being rated no higher than Tier 3 has distinct

advantages. In addition to a Bill Lee Act tax

credit of at least $3,000 for each new job

created and a 7 percent tax credit for

investments above $200,000 in machinery and

equipment, new and expanding businesses in those

counties also can claim financial assistance

through the state's Industrial Development Fund.

That assistance amounts to $5,000 for each new

job created, up to $500,000. The money must be

used to renovate buildings, to purchase

production equipment or to improve infrastructure

at new or old sites.

Despite the new yardsticks that tend to push

counties down in the rankings, nine moved up a

notch. Rutherford climbed from Tier 2 to Tier 3,

a change that won't dramatically impact the level

of economic incentives available there this year.

Brunswick, Gaston, Person and Wilkes moved up

from Tier 3 to Tier 4, meaning new and expanding

businesses there won't be available for

Industrial Development Fund assistance.

Alamance, Catawba, Transylvania and Yadkin

counties moved from Tier 4 to Tier 5 and now will

be considered among the state's most affluent

areas, joining Mecklenburg, Wake, Forsyth and

other urban counties as areas considered in least

need of state assistance. The tax credit for new

jobs in Tier 5 counties is worth $500 and the 7

percent investment tax credit for machinery and

equipment only applies to purchases over $1

million.

|