|

Retirement Finances

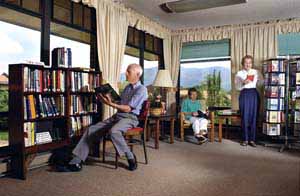

Right: Highlands Farms, a retirement community in Black

Mountain, offers residents a full range of amenities -- and a gorgeous view.

Carefree Isn't Free

You can retire comfortably, with great

healthcare, just be aware why they're

called the Golden Years

By Heidi Russell Rafferty

If your mental image of retirement evokes the Old

Folks Home, where life is slow and peaceful, then you may be shocked to learn

what the market has prepared for you and the rest of the Baby Boomers.

Retirement communities are the rage these days, places that couple many of the

same amenities available at the best resorts with top-notch medical care and

personal services. But there’s a catch. Living large at these retirement

communities isn’t cheap, with typical prices running $2,000 a month or more.

And there’s another catch: Other than your Social Security check, forget about

much if any help from Uncle Sam.

Retirement communities are popular because they offer the ability to easily

transition from independent living to assisted care to skilled nursing care over

a period of years, so you only need to move once. The package usually includes a

wide range of services. Highland Farms, a retirement community in Black

Mountain, offers three meals a day, weekly linen service, an activities program,

all utilities, housekeeping, personal assistance and an emergency call system.

“The Baby Boomers are going to

retire earlier and will want to be able to maintain an independent lifestyle,

but they also want the maintenance lifestyle,” says Pat Winebrenner, the

marketing director at Highland Farms. Most of Highland Farms’ 390 residents

live in free-standing cluster homes, paying from $1,600 to $3,700 per month,

depending on payment plan.

Being able to afford such a carefree retirement lifestyle, with secure

healthcare, is a concern shared by a growing number of people. By 2010, the

oldest of the Baby Boom generation will turn 65, according to the state Division

of Aging. They will be the first wave of more than 2 million North Carolinians

born between 1946 and 1964. They represent nearly one-third of the state

population and double the number of older adults from the previous generation.

The Division of Aging reports that it’s likely that boomers will want to

continue living in their own homes as long as possible (like their parents), but

they will want more choices, and more customized services. The same will be true

if they need residential care. Many of the high-end assisted living programs are

being developed now to appeal to boomers — first for their parents, then as

the consumers themselves, the division says.

Retirement planners say an estimated 40 percent of the population will need some

form of long-term care at least once in their lifetimes. “Long-term care” is

defined as the different kinds of help available to people with chronic

illnesses, disabilities or other conditions. More than 5 million people

nationwide receive some type of help with their daily activities — either at

home or in assisted living facilities, board and care homes, adult foster care

homes, nursing homes and adult day care centers.

But the average yearly cost of long-term care can be expensive. In North

Carolina, nursing home costs average $130-$135 per day, or $48,000 per year,

according to the state Department of Insurance. To receive the same type of care

at home, a person would pay $15,000 to $25,000 a year.

One major problem is that the aging population misunderstands financial help

available from the government, and therefore, they plan inadequately, says Kay

Tomlinson, assistant deputy commissioner of the Seniors’ Health Insurance

Information Program, or SHIIP. Most people incorrectly think they can tap into

Medicaid or Medicare, Tomlinson says. Part of Medicare pays for skilled nursing,

but it only covers up to 100 days, and only 20 days receive full coverage, she

says.

“Only 2 percent of nursing home care is covered by Medicare, because it’s

skilled nursing care. If people are getting better and no longer need the care,

Medicare won’t pay for intermediate or custodial care,” Tomlinson says.

The Medicaid benefit is for people who are impoverished. “The problem with

that is that you have to have very limited income and resources,” Tomlinson

says. “You can only have assets of $2,000 if you’re an individual and $3,000

for a couple. There is an income limit as well. Some people think they can give

away their assets to qualify, but Medicaid looks back at three years to see if

you’ve done that. Medicaid is a resource of last resort for people. It is not

good to count on it to pay for long-term care expenses.”

Renee Brumagin, marketing director for Baptist Retirement Homes of N.C., says

the misconception over Medicare and Medicaid leads families to make poor

choices. “They are always in a crisis state when some event happens, and they

have to do something quick,” she says. “The problem is that a lot of

facilities won’t even take Medicaid anymore. Then you end up in a not-good

situation with poor care.”

Baptist Retirement Homes, based in Winston-Salem, has 700 beds statewide —

including Brookridge — and will be opening its fifth facility in Concord in

October. Brumagin says the community “provides care to the poorest person who

was a farmer and on Social Security, all the way up to the founders of Lowe’s,

Tabasco and Texas Pete. We run the whole gamut.”

She notes it’s important for families to spend time investigating all of the

potential communities where their parents might locate before they get too

infirmed.

“Most of the good communities do not allow an overnight decision. There is a

lot of paperwork to fill out before you make a decision. A lot of education

still has to be done with the public. You can’t wait until you need care.”

Brumagin says that once you are admitted to Baptist, you are never asked to

leave, regardless of whether you run out of money. “But you truly have to run

out. You can’t give it away and put it into an estate. A lot of people are

living longer these days. If you outlive your resources, we pick up the

difference. We raise a lot of money for benevolent care.”

Protect Your Assets

Even the wealthiest of us should carefully consider long-term care insurance,

according to retirement planning experts who say it’s a financial tool

overlooked by many Americans.

The cost varies with your age and the options you select. The older you are, the

higher your monthly premiums will be. Although such the policy will not

appreciate or provide a return on your investment, it is a protection for your

investment portfolio. R. Michael Shively, vice president of the Estate

Preservation Department for Salomon Smith Barney Inc. in Charlotte and a

retirement planning specialist for 33 years, advises clients to consider the

product by the time they’re in their 50s. Salomon Smith Barney recently sent

out a mailing to 64,000 clients in 23 states urging the use of long-term care

insurance.

An investment side fund would not necessarily beat the value of long-term care

insurance in the long run, Shively says. “What are you going to earn (on your

investments), and what will you have at the time when you need it? What you’ll

find is, you never know when you’ll need that coverage,” Shively says.

But he and others caution that you should evaluate your current assets, income

and personal preferences before deciding whether to buy long-term insurance. You

may pay premiums for 15 to 20 years before you need the services. Shively,

Jackson and Tomlinson agree that insurance is for people who either want to

protect their assets, provide their assets for heirs or want to maintain choice

and be independent from the government or family for care.

“We don’t recommend it, and most financial planners don’t recommend it,

for people who have less than $80,000 to $100,000 in assets — not counting the

house,” Tomlinson says. “The premiums will rise. Certainly, people on fixed

incomes should not be thinking about it. There are some planners who say that

millionaires don’t need it, either, because they can self-pay, but that’s a

personal preference.”

The state Department of Insurance recommends that you should not pay more than 7

to 10 percent of your income for health premiums, including long-term care

insurance. “For people in that range who have assets they want to protect,

long-term health insurance is a good product,” Tomlinson says.

Weigh the Options

You should buy long-term care insurance before you become disabled or seriously

ill. Many people won’t begin using their benefits when they are in their 80s,

but an unexpected accident, disability or disease such as Alzheimer’s may

cause you to need them sooner.

Buying long-term care insurance requires three main decisions. The first is your

daily benefit, or the amount of money you will receive on a daily basis for your

care. You can usually select from $50 to $250 per day. The second is the benefit

period, or the length of time you will receive payments. You can usually select

a specific number of years, or you can choose a lifetime plan. The average stay

in a nursing home is 2 ½ to 3 years. The third consideration is the elimination

period, or the number of days that you will be responsible for paying for your

care before the insurance begins to pay. This is like most insurance deductibles

except it is stated in a number of days instead of dollars.

Bob Jackson, the director of the AARP office for North Carolina, says that in

the past 10 to 15 years newer insurance products have emerged that provide

additional protections that the old style did not. For example, some offer an

optional inflation protection, which builds in an automatic increase each year

in per-day value of the product. “That means if you buy a $100 per day plan

today, without inflation protection, 10 to 15 years from now when you need it,

the cost for care will have gone up dramatically,” he says.

Another feature is the non-forfeiture provision, which means that, after you

have paid on the plan for a period of time and you decide you don’t want the

product anymore, you can cancel the plan. You can either get cash back or some

kind of paid up coverage, Jackson says.

The definition of covered facilities has also improved, Jackson says. In the

past, the insurance only paid if you were in a certain type of nursing facility.

Now the policies have improved to pay for care in your home or for a family

member to care for you in their home.

“Some also provide for home modifications, such as ramps and rails,”

Tomlinson adds. “It depends on what you’re looking for. It’s just like

shopping for cars. Do you want the

basic model or the Cadillac with more bells and whistles? It depends on your

preference.”

Tomlinson says it’s important that consumers study each contract and listen

carefully to their insurance agent to determine what their policy will and will

not cover. Couples should also consider “pooled benefits.” That means they

can both use the benefits, even if one gets sick before the other.

The Department of Insurance reviews all long-term care policies, and companies

must be licensed or authorized to do business in North Carolina. Jackson says

consumers should ask the Insurance Department for a carrier’s history of rate

hikes.

“What we’ve seen over the last 10 years is that products were sold, and the

companies said they wouldn’t raise their rates. But there was a small print

clause that said they wouldn’t raise an individual’s rates unless they

raised everyone else’s. We’ve seen a lot of companies raising rates 15 to 30

percent,” Jackson says.

Other recommendations: Make sure your agent obtains in writing the company’s

current A.M. Best Rating. Tomlinson says it should be at least an A. You also

should make sure the agent is licensed in North Carolina. In addition, nearly

all states, including North Carolina, require that insurance companies give you

a 30-day free look period, which begins after you receive the signed policy.

During this period, you can return a policy and receive a full refund.

Also look at whether your policy is tax qualified, which refers to certain tax

advantages for buying long-term care insurance. Most are, Tomlinson says. The

federal government does not tax benefits paid under tax-qualified policies, and

a portion of the premiums you pay may be tax deductible.

To receive benefits under a tax-qualified policy, a medical professional must

certify that you will need help with two out of six activities of daily living

for at least 90 days. The amount of your premiums that you can deduct depends on

your age at the end of each taxable year.

Long-term care insurance isn’t for everyone, but other options exist for

people who can’t afford the premiums and who also may not qualify for

Medicaid. R. Michael Shively, vice president of the Estate Preservation

Department for Salomon Smith Barney Inc. in Charlotte, says companies have found

other ways to package long-term care provisions with other products.

“Some combine a single premium life insurance product with a long-term care

feature,” Shively says. “So you have someone who doesn’t want to pay the

(long-term care insurance) premiums, but perhaps they have older life insurance

policies. They can do an exchange to a new product that will also provide the

long-term care products.”

People can also consider investing in annuities, he says. “Some carriers

provide annuities with a benefit of long-term care after the annuity has been in

force for a number of years.” Shively says a lot of annuity carriers will take

a withdrawal from the annuity to provide for the long-term care insurance

premium.

People in the middle-income range should look at affordable long-term care

insurance plans, even if they only cover nursing home costs and don’t carry

the bells and whistles of more expensive policies, Shively says.

Some retirement communities also offer payment plans to help people plan better

for their future, says Karen Daniel, director of admissions and public relations

at Carol Woods, a community in Chapel Hill with 425 residents.

Carol Woods, for example, charges an entry fee based on the size of the

independent living arrangement. As part of that fee, the resident pre-pays the

cost of future healthcare that he or she will need. This “modified contract”

spreads the cost of healthcare over time, Daniel says.

“This lessens the likelihood of full medical costs at the end of a life,”

Daniel says, adding that the question one should ask is when to pay for health

care, not whether it will be needed. “You’ll pay for the healthcare either

up front, when you’re using it, or you can spread the cost along, but you will

pay for it, one way or another,” she says.

Return to magazine

index

|